Investors are constantly seeking innovative ways to expand their portfolios and maximize returns. One such financing option that has gained significant traction in recent years is the DSCR loan. This guide explains the intricacies of DSCR loans, providing real estate investors with the knowledge they need to leverage this powerful financial tool effectively.

The Fundamentals of DSCR

What is DSCR?

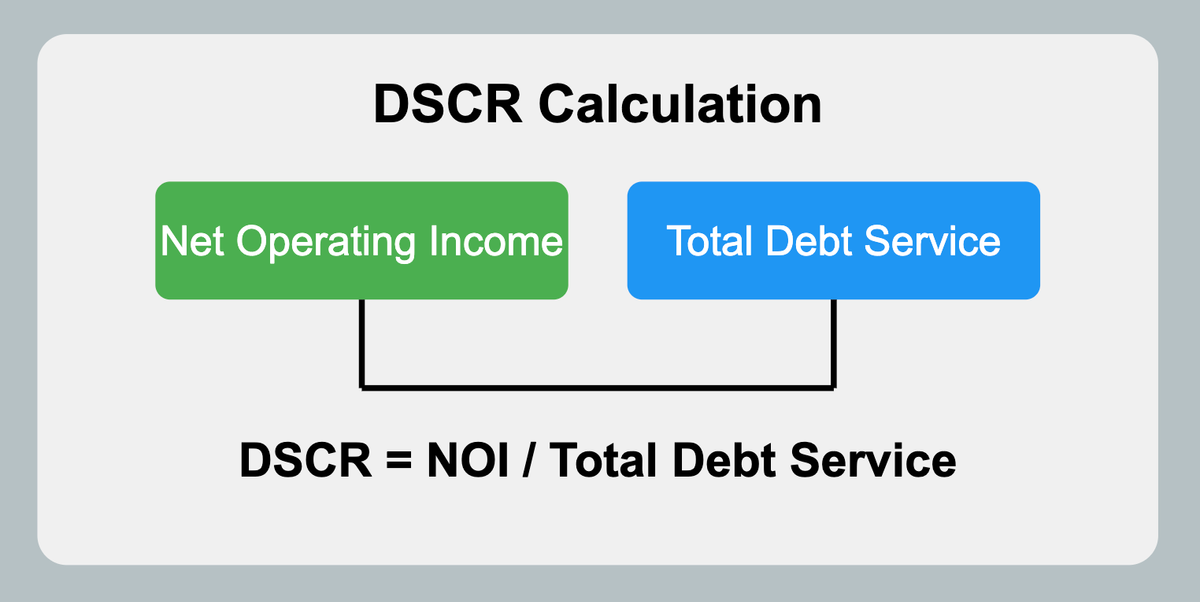

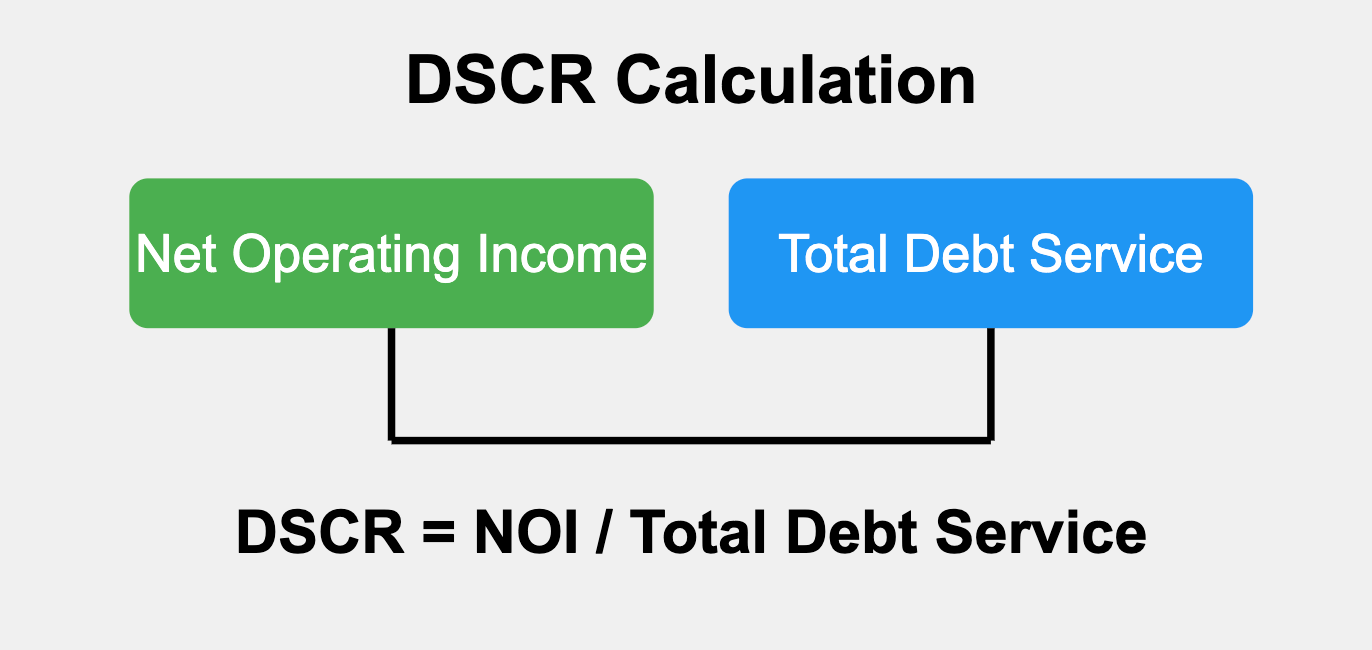

The Debt Service Coverage Ratio (DSCR) is a financial metric that measures an entity's ability to cover its debt obligations with its operating income. In real estate, it's calculated as:

Components of DSCR

Net Operating Income (NOI)

NOI represents the annual income generated by the property after accounting for all operating expenses, but before considering debt service, income taxes, capital expenditures, and depreciation.

Total Debt Service

This encompasses all debt obligations related to the property, including:

- Principal repayment

- Interest payments

- Lease payments (if applicable)

DSCR Requirements

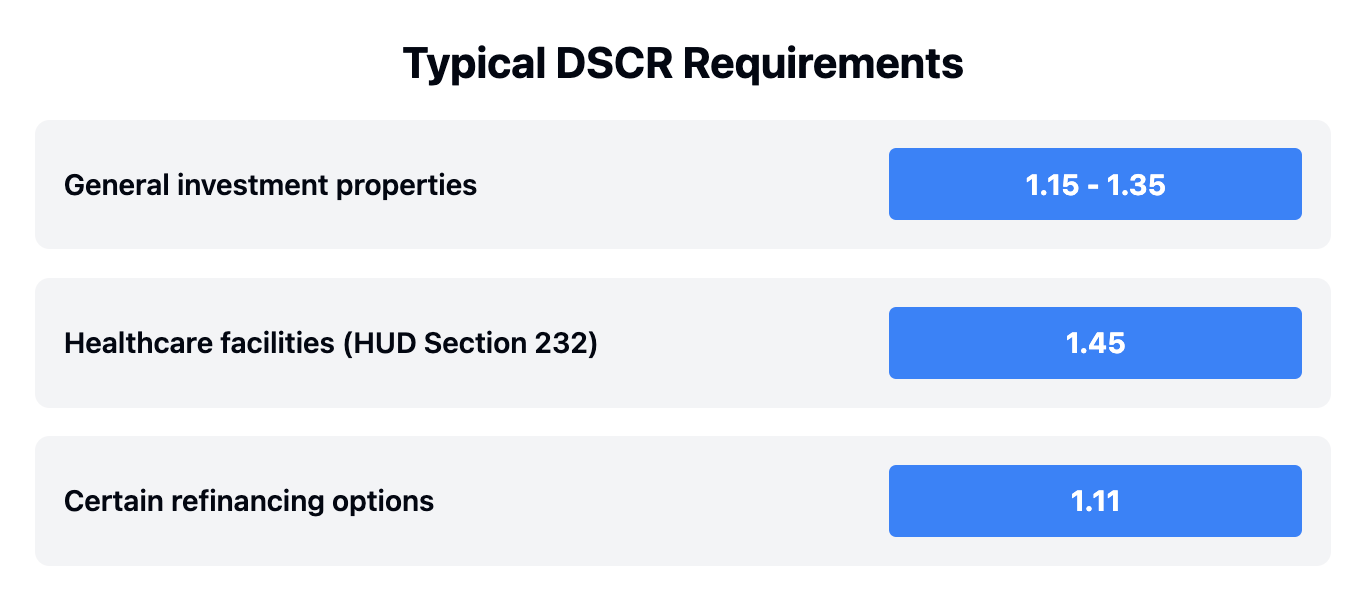

Typical minimum DSCR requirements range from 1.15 to 1.35, depending on various factors.

Some specialized programs may have different requirements:

- General investment properties: 1.15 - 1.35

- Healthcare facilities (HUD Section 232): 1.45

- Certain refinancing options (223(a)(7) and 232(i) programs): 1.11

DSCR Loans Explained

What is a DSCR Loan?

A DSCR loan is a type of non-qualified mortgage (non-QM) that uses the property's income potential, rather than the borrower's personal income, as the primary factor for loan approval.

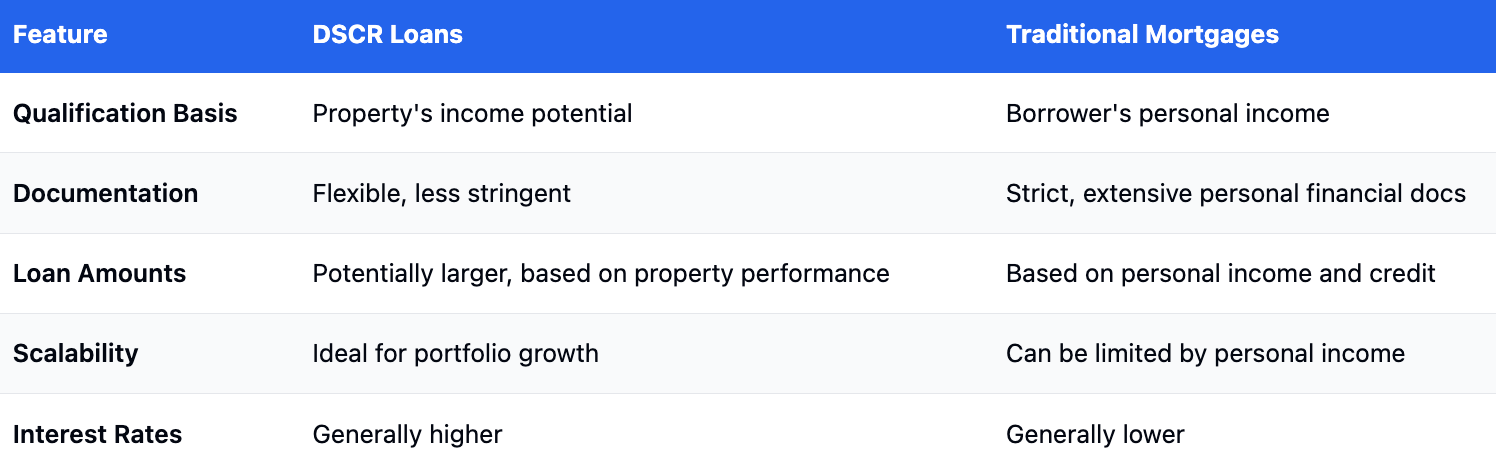

How DSCR Loans Differ from Traditional Mortgages

Focus on Property Income

DSCR loans prioritize the income-generating potential of the property itself, unlike traditional mortgages that emphasize the borrower's personal income and credit history.

Qualification Process

The qualification process for DSCR loans is based primarily on the property's DSCR, making it easier for investors with multiple properties or non-traditional income structures to qualify.

Key Features of DSCR Loans

- Income-based qualification: Emphasis on property income rather than personal finances.

- Flexible documentation: Less stringent requirements compared to traditional loans.

- Potential for larger loan amounts: Higher loan amounts based on property performance.

- Scalability for portfolio growth: Ideal for expanding property portfolios.

- Applicability to various property types: Suitable for residential, commercial, and specialized properties.

Non-QM Loans and DSCR

What is a Non-QM Loan?

Non-QM (Non-Qualified Mortgage) loans are mortgage products that don't meet the standard underwriting criteria set by government-sponsored entities like Fannie Mae or Freddie Mac. These loans offer more flexibility in their approval process.

Types of Non-QM Loans

- DSCR Loans

- Bank Statement Loans

- Asset Depletion Loans

- Interest-Only Loans

- Jumbo Loans

How DSCR Loans Fit into the Non-QM Category

DSCR loans are a specific type of non-QM loan designed for real estate investors. They allow for qualification based on the property's income rather than the borrower's personal income, making them ideal for investors with multiple properties or non-traditional income sources.

Qualifying for a DSCR Loan

Credit Score Requirements

While DSCR loans focus primarily on the property's income, borrowers typically need a credit score of at least 620 to qualify. However, some lenders may have higher credit score requirements, especially for larger loan amounts or lower DSCRs.

Loan Amounts

Minimum Loan Amounts

DSCR loans often have minimum loan amounts ranging from $100,000 to $150,000, depending on the lender and property location.

Maximum Loan Amounts

Maximum loan amounts can vary widely, with some lenders offering up to $5 million or more for qualified properties and borrowers. The exact maximum often depends on the property's value, income potential, and the lender's policies.

Down Payment Requirements

Most DSCR loans require a down payment of 20-25% of the property's value. However, this can vary based on the property type, location, and overall strength of the application.

Prepayment Penalties

Many DSCR loans come with prepayment penalties, typically lasting for the first 2-5 years of the loan term. These penalties can vary in structure and amount, so it's important for borrowers to carefully review and negotiate these terms.

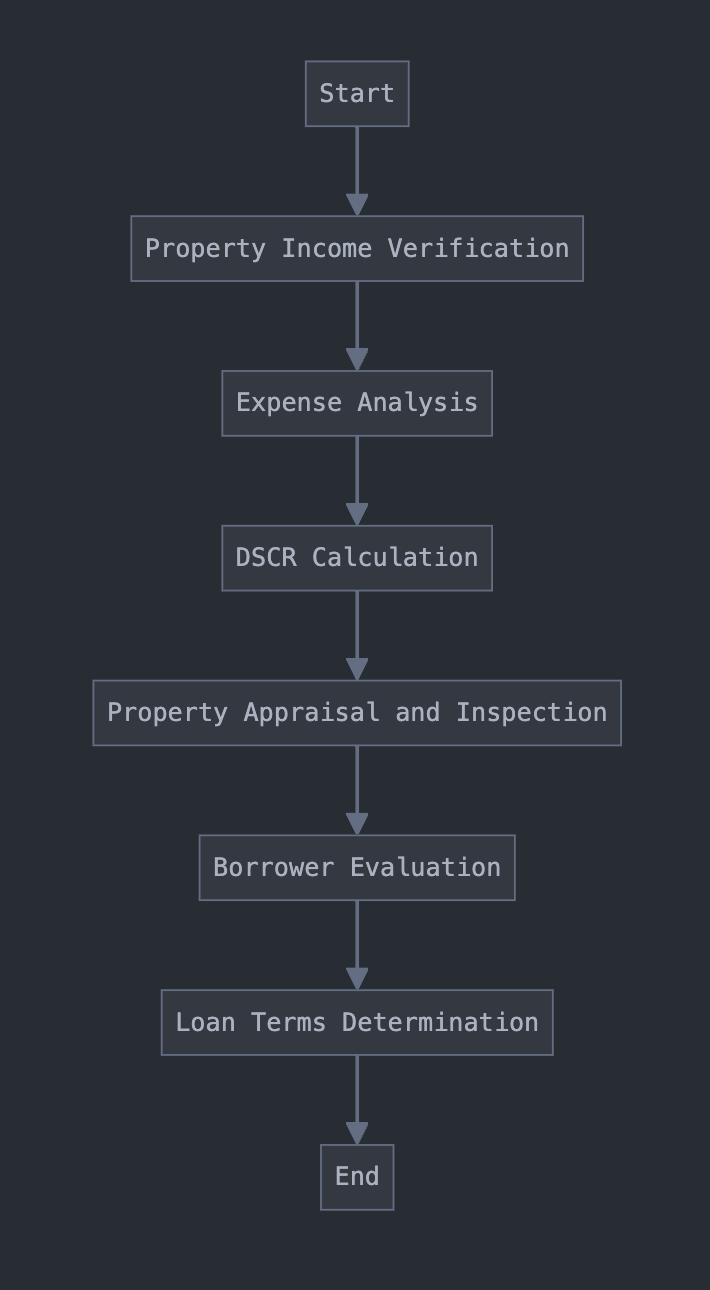

The DSCR Loan Underwriting Process

Property Income Verification

Lenders require proof of the property's income-generating potential.

Existing Rentals

- Rent rolls

- Lease agreements

- Historical occupancy rates

- Bank statements showing rent deposits

New Investments

For properties without established rental history, lenders may consider market rental rates for similar properties in the area.

Expense Analysis

Lenders will examine:

- Property tax records

- Insurance costs

- Utility bills

- Maintenance and repair expenses

- Property management fees

DSCR Calculation and Assessment

Lenders calculate the DSCR to assess whether the property generates enough income to cover the debt service. A higher DSCR indicates a stronger ability to meet debt obligations.

Property Appraisal and Inspection

An appraisal ensures that the property's value aligns with the loan amount. Inspections assess the property's physical condition and identify any potential issues.

Borrower Evaluation

While the focus is on the property's income, lenders still consider the borrower's creditworthiness, experience in managing similar properties, and overall financial stability.

Loan Terms Determination

Based on the DSCR, property appraisal, and borrower evaluation, lenders determine the loan terms, including interest rates, loan amounts, and repayment schedules.

Benefits and Considerations of DSCR Loans

Advantages

- Expanded investment opportunities: Access to financing based on property performance.

- Simplified qualification process: Easier approval for investors with multiple properties.

- Portfolio scalability: Ideal for growing a real estate portfolio.

- Flexibility for self-employed and non-traditional income earners: Accommodates diverse income structures.

- Potential for larger loan amounts: Higher leverage for income-generating properties.

Considerations

- Higher interest rates: Non-QM loans generally come with higher rates.

- Stricter DSCR requirements: Properties must generate sufficient income to meet lender standards.

- Market sensitivity: Property income can fluctuate with market conditions.

- Importance of accurate projections: Inaccurate income or expense projections can impact loan performance.

- Limited options for owner-occupied properties: DSCR loans are primarily for investment properties.

DSCR Loans Across Different Real Estate Sectors

Residential Investment Properties

DSCR loans are commonly used for single-family rentals, multi-family properties, and vacation rentals. These properties provide steady rental income, making them suitable candidates for DSCR financing.

Commercial Real Estate

Commercial properties like office buildings, retail spaces, and warehouses can also be financed through DSCR loans. The key is their ability to generate consistent rental income to meet debt obligations.

Healthcare Facilities

DSCR loans are particularly relevant for healthcare facilities, such as nursing homes and assisted living centers, where stable income streams are critical. Programs like HUD Section 232 cater specifically to this sector, with higher DSCR requirements.

Strategies for Improving DSCR

Increasing Property Income

Enhancing the property's revenue through rent increases, adding amenities, or diversifying income sources can improve DSCR.

Reducing Operating Expenses

Cutting costs on utilities, maintenance, or property management can increase NOI, thereby improving the DSCR.

Refinancing Existing Debt

Refinancing at a lower interest rate or extending the loan term can reduce debt service, improving DSCR.

Value-Add Improvements

Investing in property upgrades can increase its value and rental income, enhancing the DSCR.

Optimizing Property Management

Efficient property management can reduce vacancies, increase rent collections, and streamline operations, all contributing to a better DSCR.

Choosing a Lender for DSCR Loans

Importance of Specialized Lenders

DSCR loans typically require choosing a lender that offers alternative loan types. Traditional banks and credit unions often don't provide DSCR loans, so investors need to seek out specialized mortgage lenders or brokers who work with non-QM products.

Factors to Consider When Selecting a Lender

- Experience with DSCR loans: Look for lenders with a track record in DSCR financing.

- Range of non-QM products offered: A variety of products indicates flexibility.

- Competitive rates and terms: Compare rates and terms across multiple lenders.

- Flexibility in underwriting guidelines: Flexible underwriting can ease the qualification process.

- Quality of customer service and support: Strong support ensures a smoother loan process.

The Role of Mortgage Brokers

Mortgage brokers can be valuable resources for investors seeking DSCR loans, as they often have relationships with multiple lenders specializing in non-QM products. They can help find the best rates and terms, and guide investors through the application process.

The Future of DSCR Loans in Real Estate Financing

Technology Integration

Advancements in technology, such as digital applications and automated underwriting, are likely to streamline the DSCR loan process, making it more accessible and efficient for investors.

Market Cycles

As real estate markets fluctuate, the demand for DSCR loans may rise or fall. Investors should stay informed about market trends and how they impact DSCR loan availability and terms.

Regulatory Environment

Changes in regulations could affect the availability and structure of DSCR loans. Investors should monitor legislative developments to understand potential impacts on their financing options.

Investor Demand

As more investors recognize the benefits of DSCR loans, demand is

expected to grow. This could lead to increased competition among lenders and potentially more favorable loan terms for borrowers.

Alternative Property Types

As the real estate market evolves, DSCR loans may expand to include alternative property types, such as mixed-use developments, co-working spaces, and short-term rental properties.

DSCR loans represent a significant innovation in real estate financing, offering investors a powerful tool to build and expand their portfolios. By focusing on a property's income-generating potential rather than the borrower's personal finances, these loans open up new possibilities for investors, particularly those with non-traditional income structures or multiple investment properties.

However, success with DSCR loans requires a thorough understanding of the underlying principles, careful financial analysis, and strategic property management. Investors must accurately project income and expenses, stay attuned to market conditions, and continuously work to improve their properties' performance.

As with any financial product, DSCR loans come with their own set of risks and considerations. Investors should carefully weigh the benefits against the potential drawbacks and ensure that DSCR loans align with their overall investment strategy and risk tolerance.