The Nationwide Multistate Licensing System & Registry (NMLS) provides an important, transparency-driven service to consumers through its NMLS Consumer Access website. This guide will answer key questions about NMLS Consumer Access, its legitimacy, and how it works, ensuring you have all the information you need to make informed decisions about your lender.

For more information about mortgages, lending, or real estate generally, feel free to reach out to me directly at the link below.

https://cal.com/michaeltennant

What is NMLS Consumer Access?

Overview

NMLS Consumer Access is a public, fully searchable website that provides information on state-licensed companies, branches, and individuals licensed and registered through the NMLS. It was established to enhance transparency and consumer protection in the financial services industry.

Purpose

The primary goal of NMLS Consumer Access is to offer the public access to administrative and licensing information about financial professionals and companies. This service is in line with the SAFE Mortgage Licensing Act of 2008, which aims to safeguard consumers by ensuring mortgage professionals meet specific standards.

What Does NMLS Stand For?

NMLS stands for Nationwide Multistate Licensing System. It is the system of record for non-depository financial services licensing or registration, used by regulatory agencies across the United States, including U.S. territories like Puerto Rico, the U.S. Virgin Islands, and Guam.

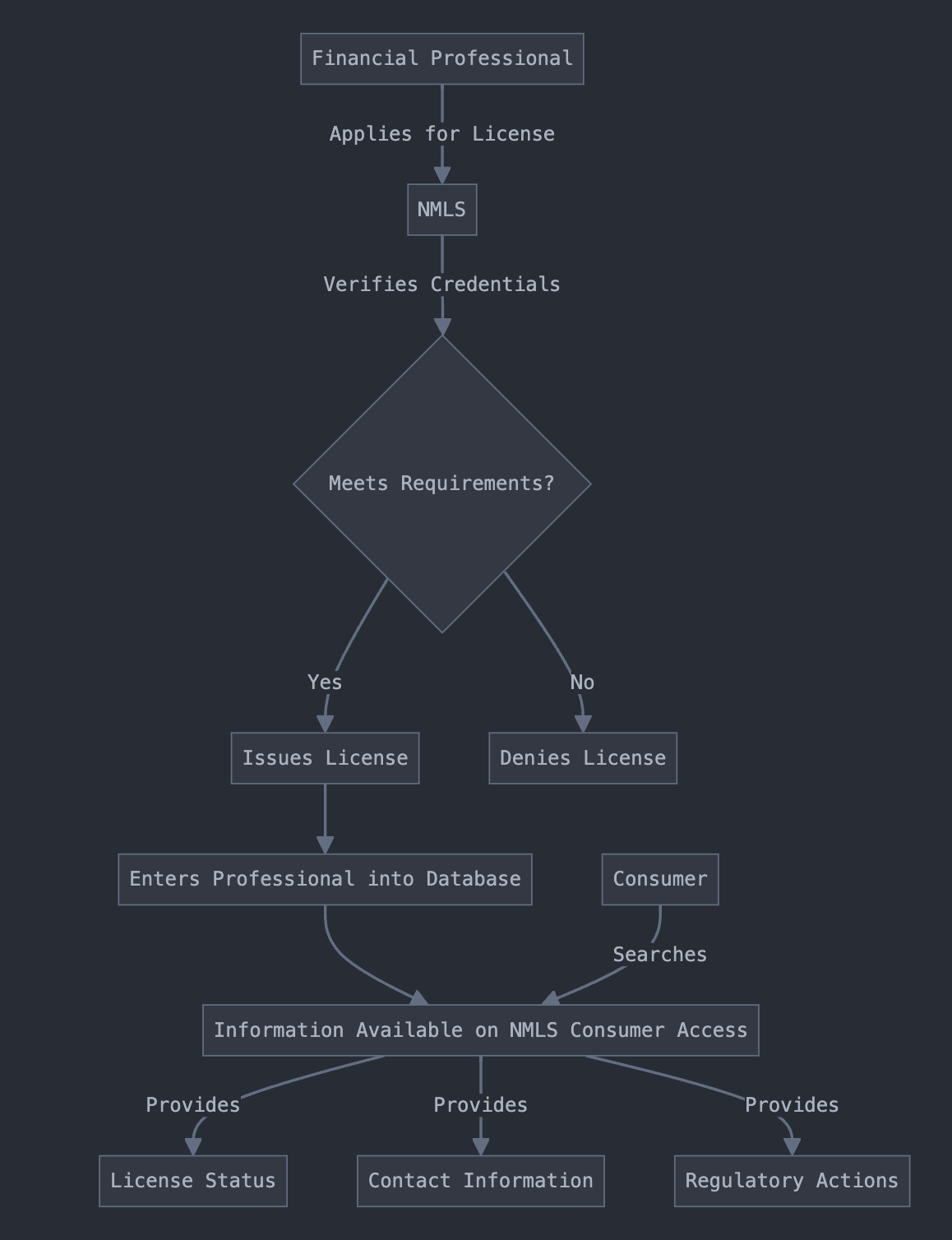

How Does NMLS Work?

NMLS Process Flowchart

Licensing and Registration

NMLS facilitates the licensing and registration of mortgage loan originators (MLOs), mortgage companies, and other financial service providers. The system ensures these professionals meet stringent criteria, including educational requirements, background checks, and ongoing education to maintain their licenses.

Centralized Database

NMLS acts as a centralized database, helping regulatory agencies manage state licensing programs. It provides a unified platform for license applications, renewals, and tracking, ensuring that all licensed individuals and entities comply with state regulations.

Is NMLS Consumer Access Legitimate?

Legitimacy and Trustworthiness

NMLS Consumer Access is a legitimate and trustworthy resource. It is maintained by the Conference of State Bank Supervisors (CSBS) and is designed to protect consumers by providing accurate and up-to-date information on licensed mortgage professionals (CSBS).

How Often is NMLS Consumer Access Updated?

The information on NMLS Consumer Access is regularly updated to reflect the most current data. Updates occur as soon as changes are made in the NMLS database, ensuring that consumers have access to the latest information.

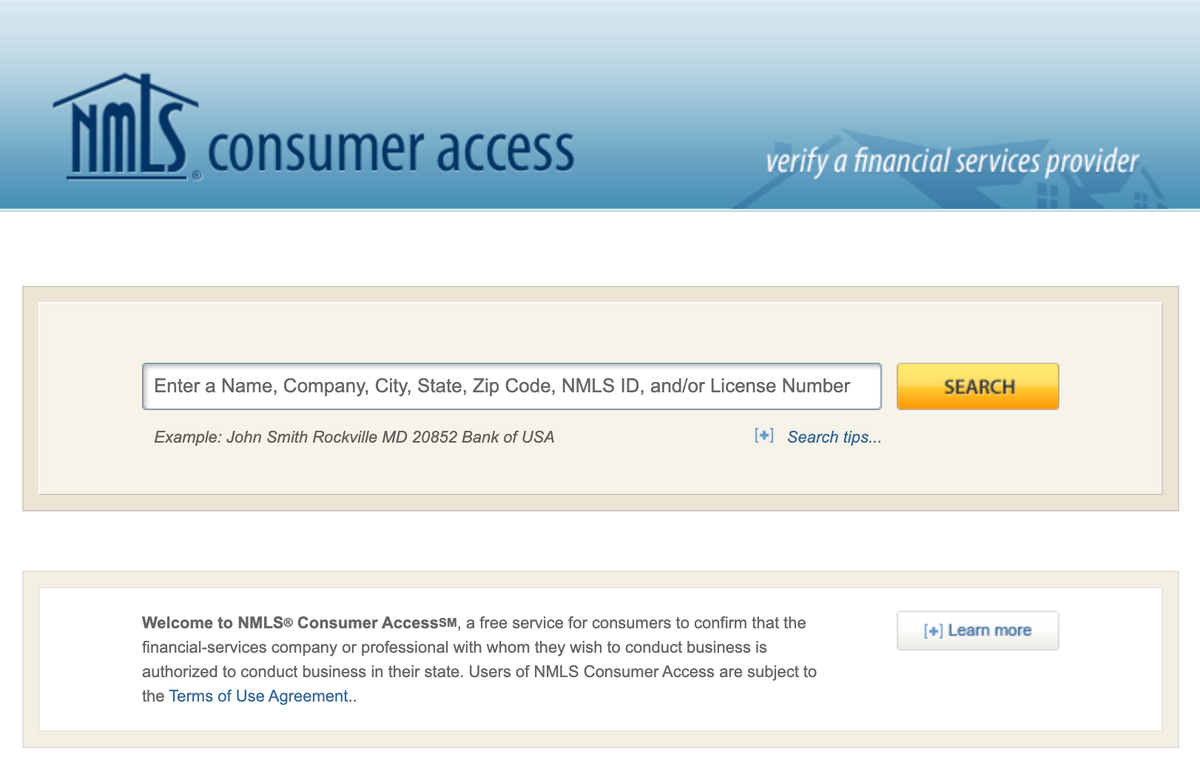

How to Use NMLS Consumer Access

Searching for Information

Consumers can use NMLS Consumer Access to search for licensed mortgage professionals and companies by name, NMLS ID, or location. The website provides detailed information, including:

- Individual or company name

- NMLS ID

- Contact information (address, phone number, email)

- Licensing status and history

- Regulatory actions, if any

Verifying Credentials

To verify the credentials of a mortgage professional, simply enter their NMLS ID or name into the search bar on the NMLS Consumer Access website. This will display their licensing information and any regulatory actions, helping you make an informed decision.

Benefits of NMLS Consumer Access

Consumer Protection

NMLS Consumer Access enhances consumer protection by ensuring that only qualified and properly vetted individuals and companies can operate in the mortgage industry. It helps prevent fraud and deceptive practices by providing transparency.

Ease of Use

The website is user-friendly, allowing consumers to quickly and easily access important information about mortgage professionals. This ease of use empowers consumers to make better decisions and fosters trust in the financial services industry.

Accountability

By making licensing information publicly available, NMLS Consumer Access holds mortgage professionals accountable. This accountability helps maintain high standards in the industry and promotes ethical practices.

FAQs

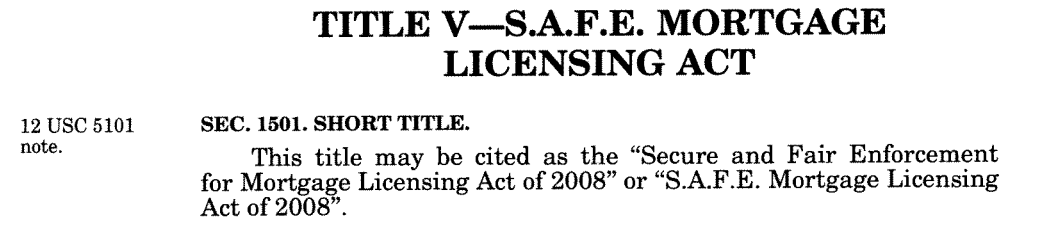

What is the SAFE Act?

The SAFE Act (Secure and Fair Enforcement for Mortgage Licensing Act of 2008) is a federal law that mandates the licensing and registration of all mortgage loan originators. It aims to protect consumers by ensuring that MLOs meet specific standards of competency and ethics.

https://www.hud.gov/sites/documents/DOC_19673.PDF

Who Needs an NMLS ID?

All state-licensed mortgage companies, branches, and individual mortgage loan originators must have an NMLS ID. This unique identifier follows them throughout their career, ensuring that their licensing and regulatory history is easily accessible.

Can Consumers Trust the Information on NMLS Consumer Access?

Yes, consumers can trust the information on NMLS Consumer Access. The website is maintained by the CSBS and is updated regularly to ensure accuracy.

When was the NMLS Established?

The NMLS was established in January 2008. It was created by the Conference of State Bank Supervisors (CSBS) and the American Association of Residential Mortgage Regulators (AARMR) to improve regulation and consumer protection in the mortgage industry (CSBS).

Why was the Name 'Nationwide Mortgage Licensing System' Changed to 'Nationwide Multistate Licensing System'?

The name was changed to 'Nationwide Multistate Licensing System' to reflect its expanded role. Initially focused solely on mortgage licensing, the system now includes other state-licensed financial services industries, such as consumer finance and money services businesses.

What is the Role of U.S. Congress in the Establishment of the NMLS?

The U.S. Congress played a crucial role by adopting the NMLS as part of the SAFE Act in response to the 2008 financial crisis. This federal endorsement helped standardize the licensing requirements and improve regulatory oversight across states.

What Caused the Shift from Banks to Mortgage Companies for Home Loans in the Early 2000s?

The shift from banks to mortgage companies for home loans in the early 2000s was driven by mortgage companies offering more flexible lending options and quicker approval processes compared to traditional banks. This flexibility made them a more attractive option for many homebuyers.

What was the Impact of This Shift on Prospective Homeowners?

The shift led to increased risks and sometimes deceptive practices by mortgage companies, negatively impacting prospective homeowners. This contributed to the 2008 financial crisis and highlighted the need for better regulatory oversight, which was addressed by the establishment of the NMLS and the enactment of the SAFE Act.

How Many Hours of Education are Required Annually for MLOs to Maintain Their State Licenses?

Mortgage loan originators (MLOs) are required to complete eight hours of continuing education annually to maintain their state licenses. This ongoing education ensures that they stay current with industry practices and regulatory changes.

Who Must Maintain an Active Registration in NMLS?

Federally regulated depository institutions, such as banks and credit unions, and the mortgage loan originators (MLOs) they employ must maintain an active registration in NMLS. This requirement ensures ongoing compliance with federal and state regulations.

Sign up for Tennant Lending

Tennant lending is a real estate education center. Our mission is helping families grow wealth by facilitating real estate ownership throughout the country.

No spam. Unsubscribe anytime.

Additional Resources

NMLS Consumer Access is a vital tool for consumers seeking information about mortgage professionals. It enhances transparency, promotes consumer protection, and ensures accountability in the financial services industry. By understanding how to use NMLS Consumer Access, you can ensure that you are working with qualified and trustworthy mortgage professionals.

For more information, visit the NMLS Consumer Access website.