Determine your home’s REAL appraisal and ensure that valuations are conducted fairly and accurately.

Tennant Lending

Tennant lending is a real estate education center. Our mission is helping families grow wealth by facilitating real estate ownership throughout the country.

Discover Our Featured Posts

Featured Posts

Determine your home’s REAL appraisal and ensure that valuations are conducted fairly and accurately.

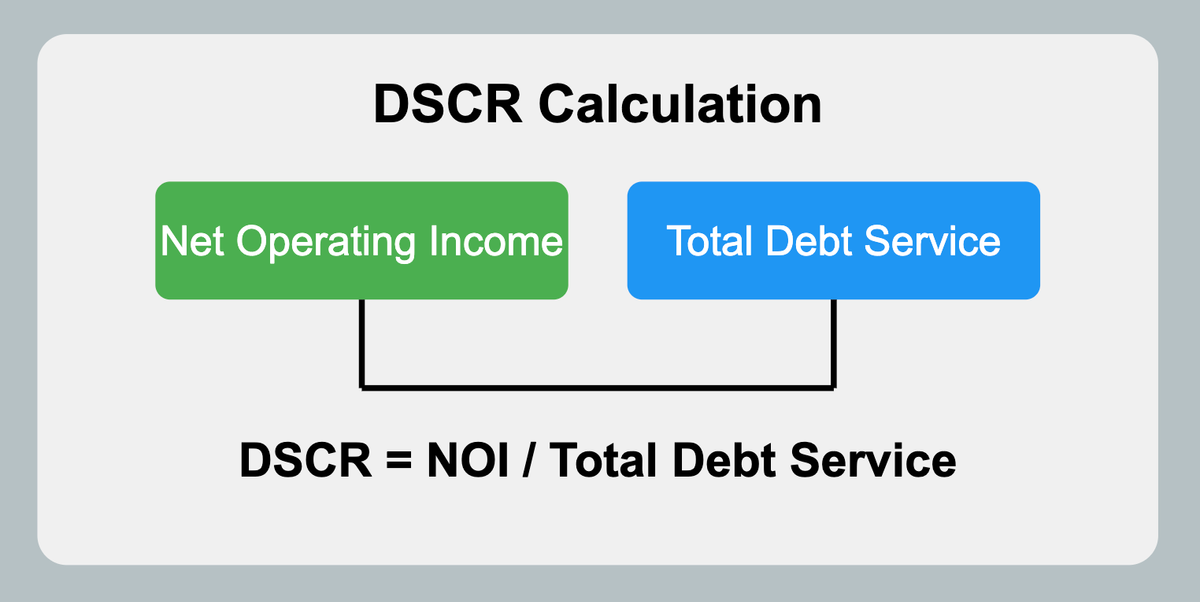

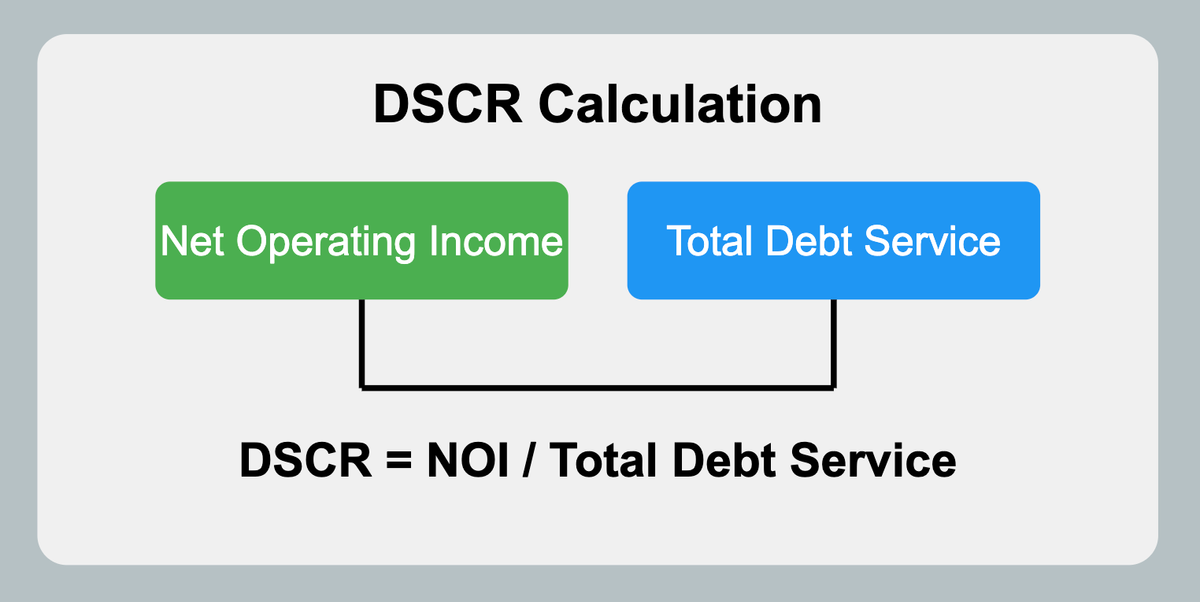

By mastering the intricacies of DSCR loans, savvy investors can leverage this tool to build robust, scalable real estate portfolios that generate steady cash flow and long-term wealth.

By mastering the intricacies of DSCR loans, savvy investors can leverage this tool to build robust, scalable real estate portfolios that generate steady cash flow and long-term wealth.

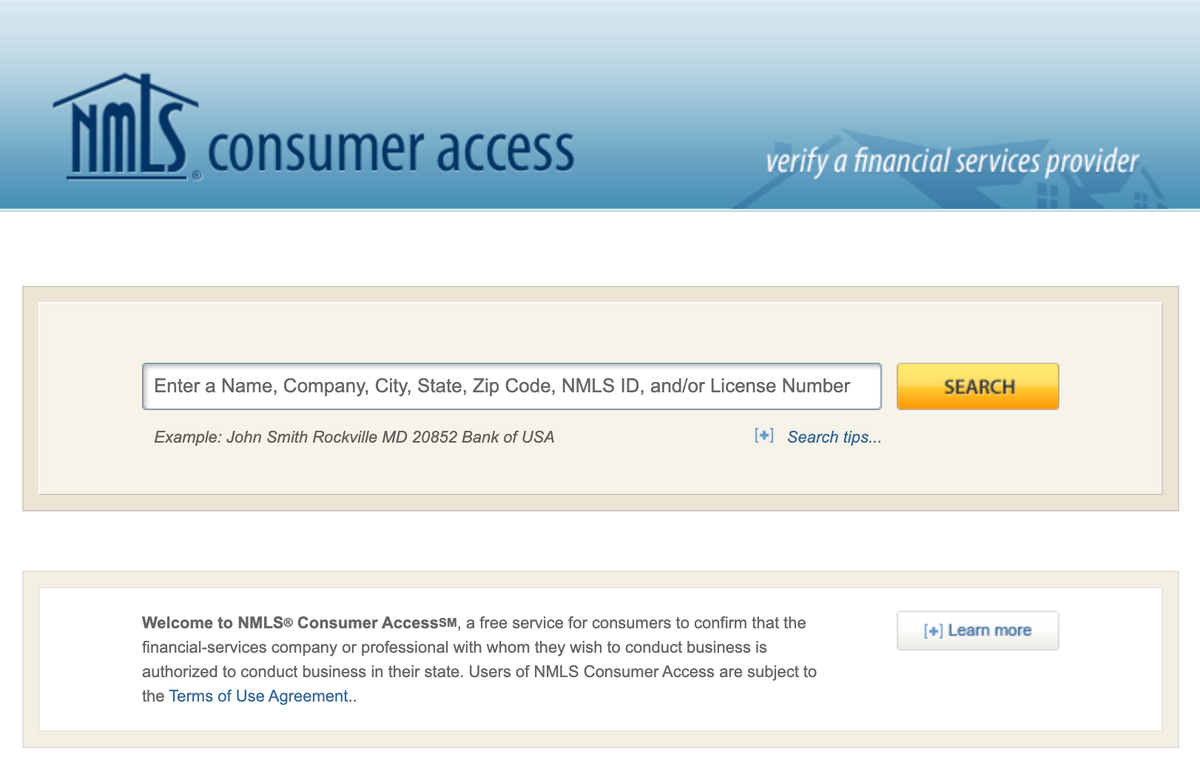

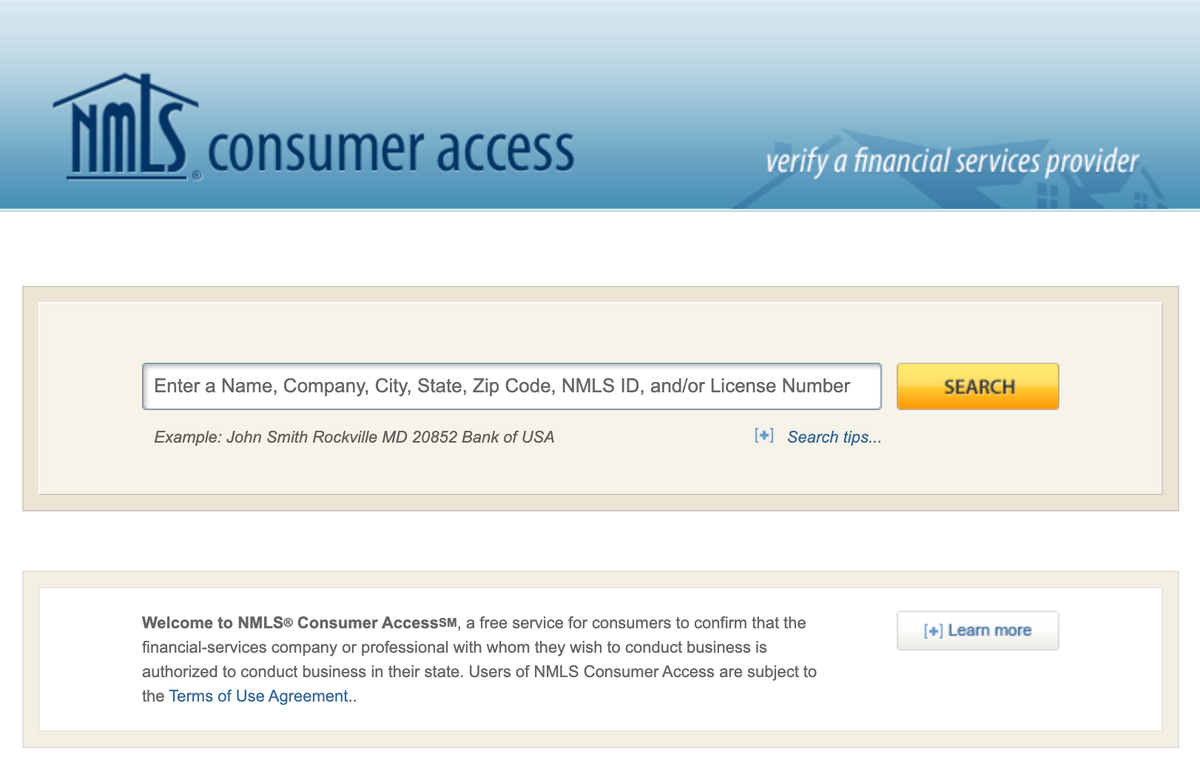

NMLS Consumer Access is a public website that lets you verify the licensing and registration of mortgage professionals. Learn how to use it to ensure you're working with trustworthy lenders.

NMLS Consumer Access is a public website that lets you verify the licensing and registration of mortgage professionals. Learn how to use it to ensure you're working with trustworthy lenders.

Yes, you can use a VA backed loan to purchase a multli-family property, with a few conditions. This guide will walk you through the process, benefits, and considerations of using a VA loan to purchase multi-family properties for investment or residence.

Yes, you can use a VA backed loan to purchase a multli-family property, with a few conditions. This guide will walk you through the process, benefits, and considerations of using a VA loan to purchase multi-family properties for investment or residence.

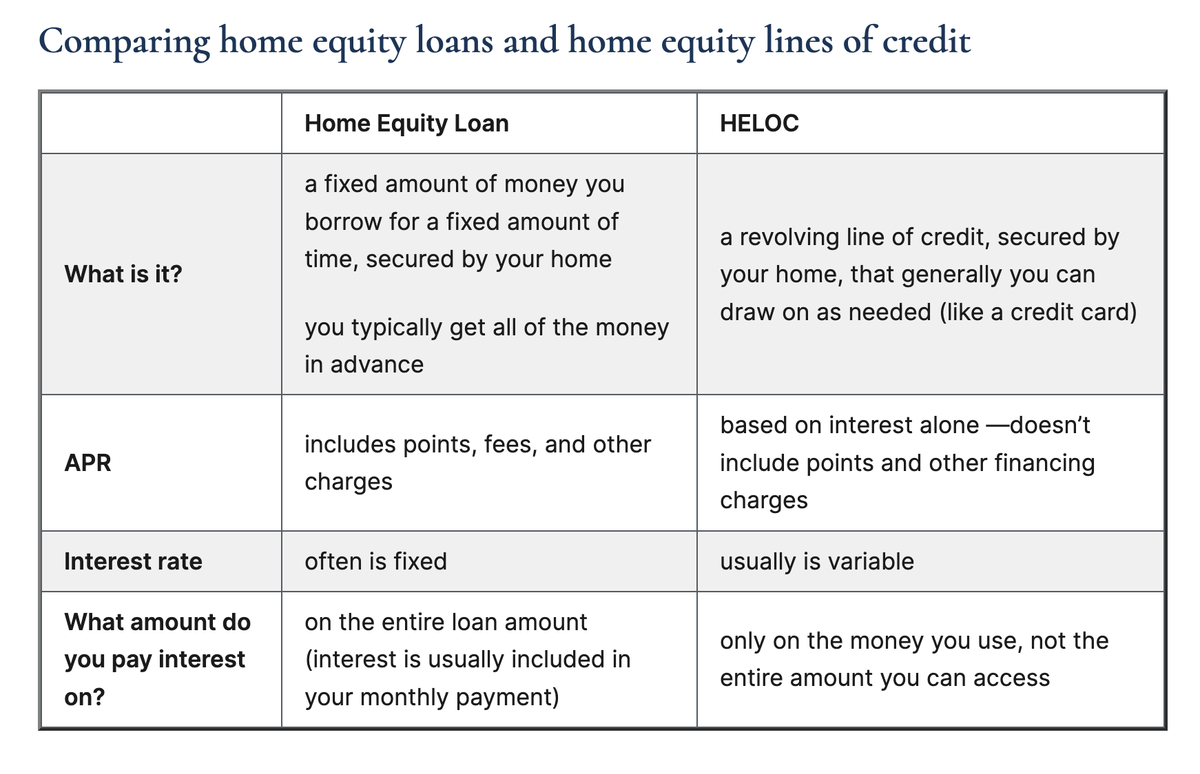

This comprehensive guide explains the differences between Home Equity Lines of Credit (HELOCs) and Home Equity Loans, detailing their advantages, disadvantages, and how to determine the best option for leveraging your home equity for financial needs.

This comprehensive guide explains the differences between Home Equity Lines of Credit (HELOCs) and Home Equity Loans, detailing their advantages, disadvantages, and how to determine the best option for leveraging your home equity for financial needs.

In this article, we'll guide you through the process of calculating your home equity, delve into the specifics of HELOC, and answer some common questions related to HELOC payments and calculations.

In this article, we'll guide you through the process of calculating your home equity, delve into the specifics of HELOC, and answer some common questions related to HELOC payments and calculations.

Getting approved for a VA home loan can be a straightforward process if you know what to expect. Here's a 7 step guide to help you navigate the VA loan approval process.

Getting approved for a VA home loan can be a straightforward process if you know what to expect. Here's a 7 step guide to help you navigate the VA loan approval process.

This article highlights the difference between a soft credit pull and a hard credit pull, and explains why soft credit pulls make sense for buyers early in their real estate journey.

This article highlights the difference between a soft credit pull and a hard credit pull, and explains why soft credit pulls make sense for buyers early in their real estate journey.

Understanding the difference between mortgage pre-qualification and pre-approval can significantly impact your home buying journey. Pre-qualification offers a quick estimate of what you might afford, while pre-approval provides a more detailed and credible assessment of your borrowing power.

Understanding the difference between mortgage pre-qualification and pre-approval can significantly impact your home buying journey. Pre-qualification offers a quick estimate of what you might afford, while pre-approval provides a more detailed and credible assessment of your borrowing power.

This guide explains what a Home Equity Line of Credit (HELOC) is, detailing its benefits, requirements, potential drawbacks, and how it works, along with tips for applying and managing a HELOC effectively.

This guide explains what a Home Equity Line of Credit (HELOC) is, detailing its benefits, requirements, potential drawbacks, and how it works, along with tips for applying and managing a HELOC effectively.

Read Our Latest Posts

Latest Posts

Created by the original G.I. Bill (Servicemen’s Readjustment Act of 1944), the VA-Guaranteed Home Loan program has helped generations of Veterans, Service members, and their families enjoy the dream of homeownership and the opportunity to retain their homes in times of temporary financial hardship.