Determine your home’s REAL appraisal and ensure that valuations are conducted fairly and accurately.

Tennant Lending

Tennant lending is a real estate education center. Our mission is helping families grow wealth by facilitating real estate ownership throughout the country.

Read Our Latest Posts

Latest Posts

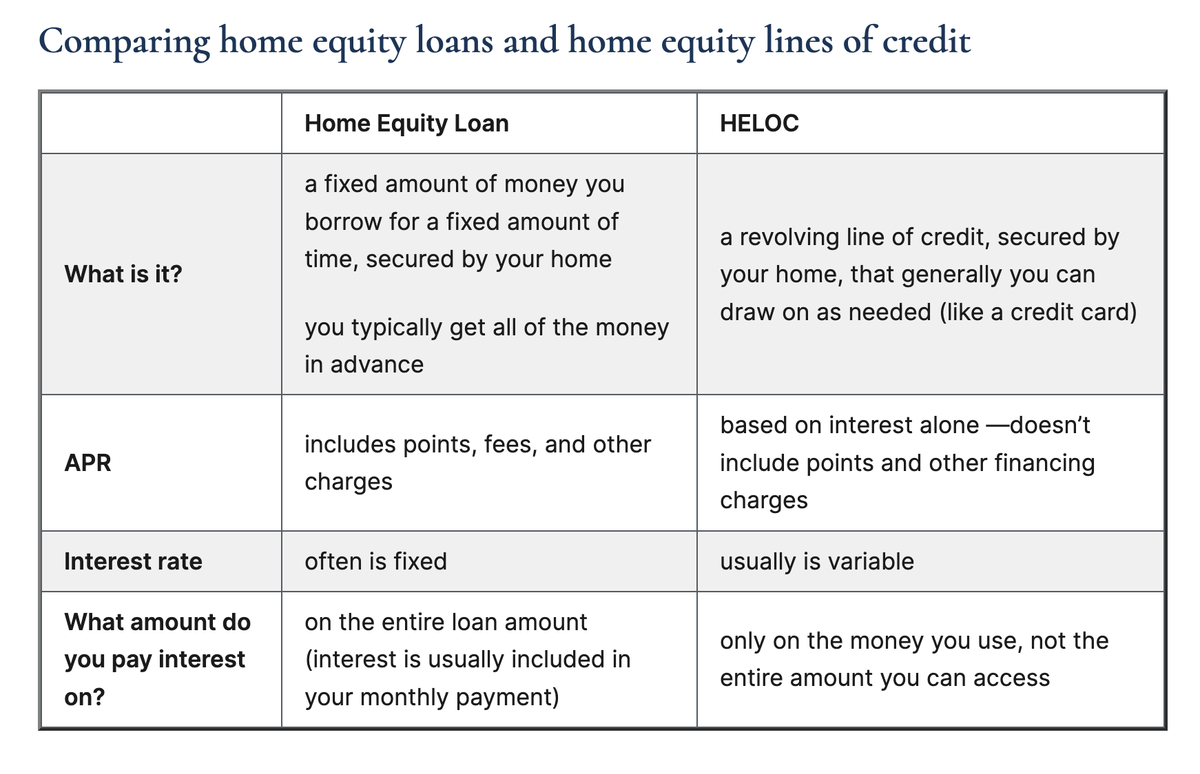

In this comprehensive guide, we will explore various aspects of HELOCs and their tax consequences, helping you navigate the complexities of tax deductions, capital gains, and reassessments.

This article delves into the various assistance programs available, answering common questions and providing valuable insights to help you navigate the home buying process.

This comprehensive guide will help you understand what an underwater mortgage is, the various refinancing options available, and other critical considerations to manage your financial situation effectively.

Recent changes in eligibility and loan limits are particularly relevant for veterans in California, given the state's high real estate prices. This article will explore these changes and their impact on California veterans.

This comprehensive guide will help you manage interest rate fluctuations and make informed decisions about jumbo loans in California.

Yes, you can use a VA backed loan to purchase a multli-family property, with a few conditions. This guide will walk you through the process, benefits, and considerations of using a VA loan to purchase multi-family properties for investment or residence.

In this article, we will explore the intricacies of jumbo loans in California, including their limits, qualifications, and potential drawbacks.

This comprehensive guide aims to demystify PMI, explain its necessity, and provide actionable insights for avoiding or managing it effectively.