Determine your home’s REAL appraisal and ensure that valuations are conducted fairly and accurately.

Tennant Lending

Tennant lending is a real estate education center. Our mission is helping families grow wealth by facilitating real estate ownership throughout the country.

Read Our Latest Posts

Latest Posts

In this article, we'll explore the pros and cons of these mortgage types to help you make an informed decision. Whether you're a first-time homebuyer or looking to refinance, understanding these options is key to choosing the best mortgage for your situation.

Understanding the difference between mortgage pre-qualification and pre-approval can significantly impact your home buying journey. Pre-qualification offers a quick estimate of what you might afford, while pre-approval provides a more detailed and credible assessment of your borrowing power.

While jumbo loans open the door to financing luxury properties and homes in competitive markets, they come with their own set of challenges and requirements.

Choosing the right mortgage is a crucial step in the home buying process. By understanding the differences between VA and conventional loans, you can make an informed decision that best suits your financial needs and homeownership goals.

Purchasing your first home is a significant milestone that requires careful planning and consideration. By focusing on the essential aspects such as your budget, location, and a thorough inspection, and by preparing your finances, you can make informed decisions throughout the process.

Improving your credit score, reducing your debt-to-income ratio, and ensuring a stable income can enhance your chances of getting approved for a VA loan. Additionally, working with a knowledgeable mortgage lender who understands the intricacies of VA loans is invaluable.

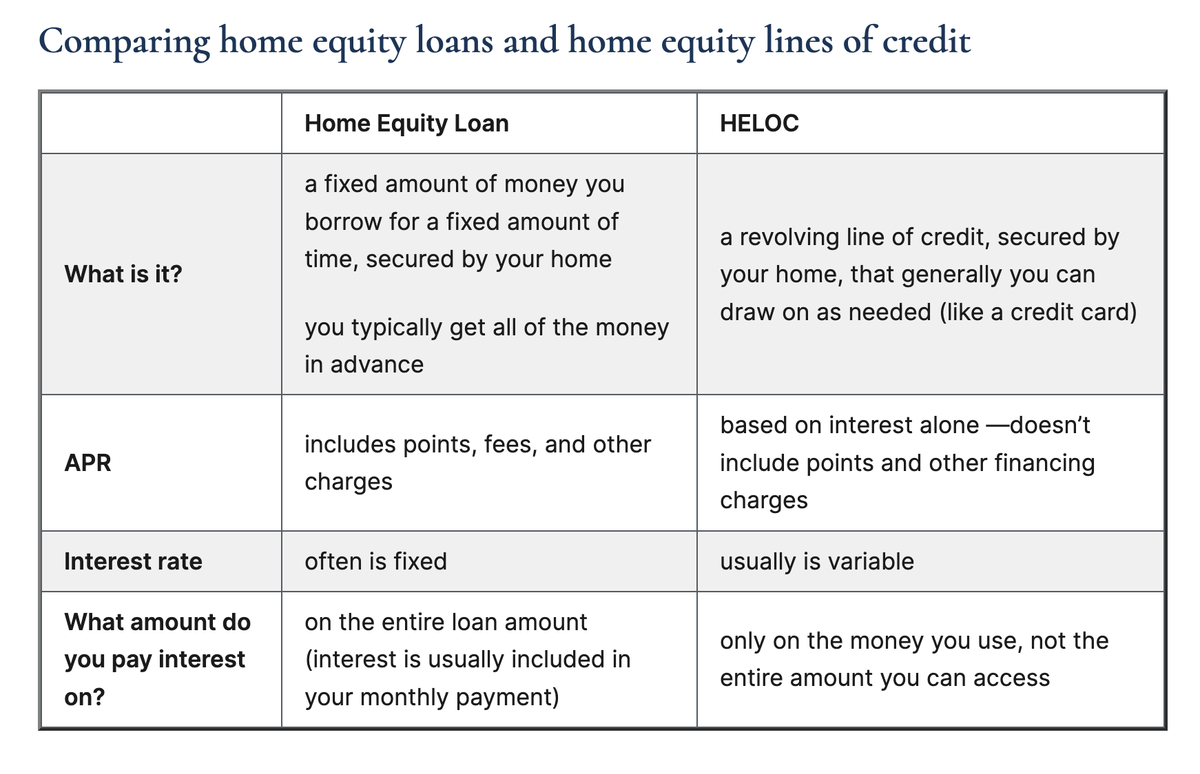

Home improvement loans can be a valuable resource for homeowners looking to upgrade their homes.

In this guide, we'll explore the essential details about VA home loan credit score requirements, leveraging insights from various authoritative sources and addressing common questions.

Understanding the importance and benefits of soft pull pre approvals can significantly enhance the loan application experience.