If you have questions about your eligibility or the VA loan process, contact Michael Tennant for more information (NMLS #1404861).

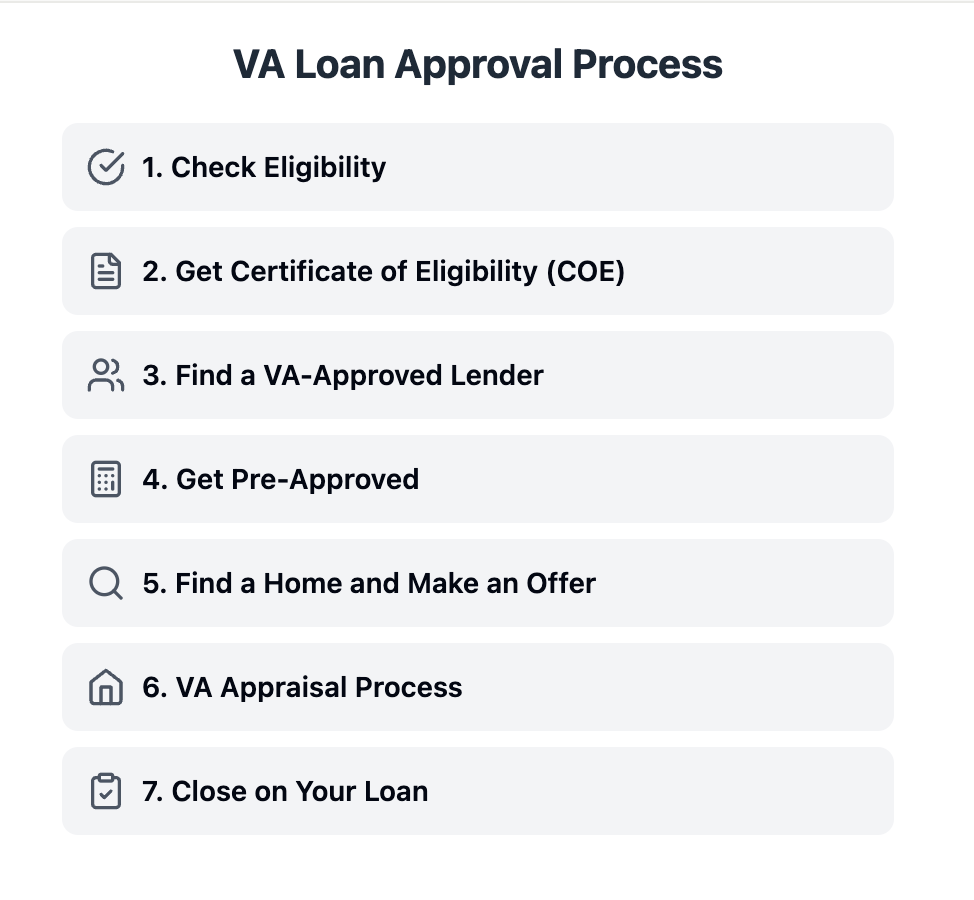

1. Check Your Eligibility

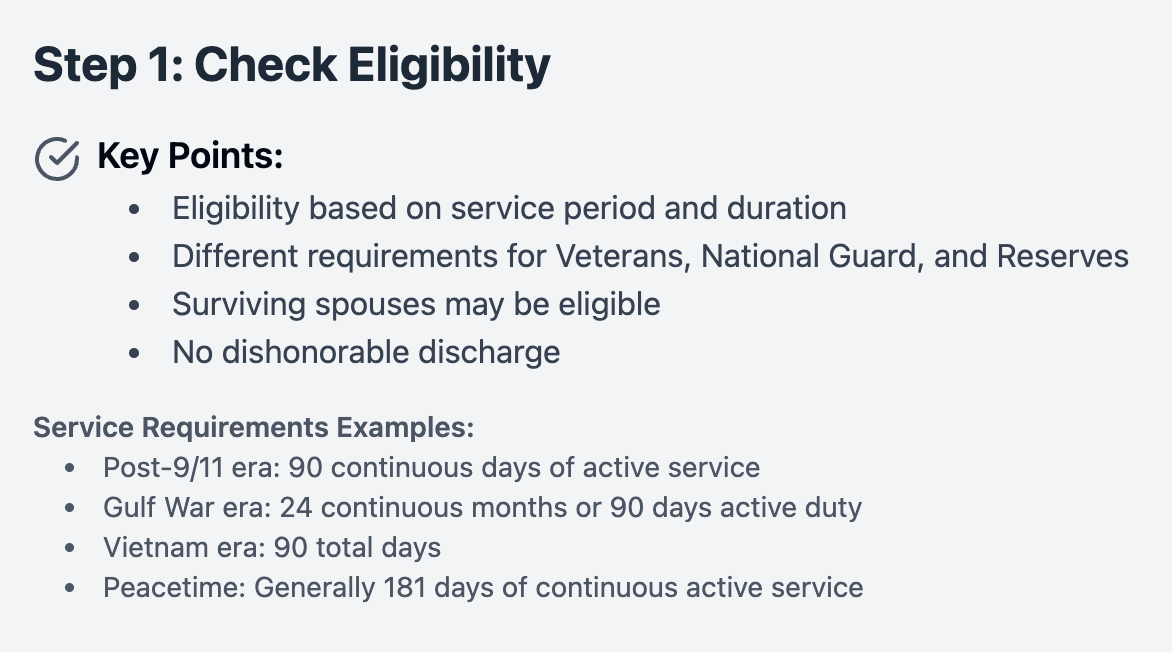

First, make sure you meet the VA's service requirements. You may be eligible if you're a veteran, active duty service member, National Guard member, or Reserve member who has met minimum service requirements. Surviving spouses of veterans may also qualify.

FAQ: What are the minimum service requirements?

The requirements vary based on when you served. For example, if you served after August 2, 1990, you need at least 24 continuous months of service or 90 days of active duty. For service between September 8, 1980, and August 1, 1990, you need at least 24 continuous months or 181 days of active duty.

Expanded Eligibility Requirements

While the basic eligibility criteria are straightforward, the specific service requirements vary based on when you served. Here's a more detailed breakdown:

VA Loan Eligibility For Veterans

- Post-9/11 era (September 11, 2001 – present): 90 continuous days of active service

- Gulf War era (August 2, 1990 – September 10, 2001): 24 continuous months or the full period (at least 90 days) for which you were called to active duty

- Vietnam era (February 28, 1961 – May 7, 1975): 90 total days

- Peacetime eras: Generally 181 days of continuous active service

VA Loan Eligibility For National Guard and Reserve members

- 90 days of active-duty service

- 6 years of service in the Selected Reserve or National Guard

VA Loan Eligibility For surviving spouses

- Your spouse died in the line of duty

- Your spouse died as a result of a service-connected disability

- Your spouse was Missing in Action or a Prisoner of War for at least 90 days

Remember, these are general guidelines. Specific situations may have different requirements, so it's always best to check with the VA or a VA-approved lender for your particular case.

2. Get Your Certificate of Eligibility (COE)

Your COE proves to lenders that you're eligible for a VA loan. You can request your COE online through the VA's eBenefits portal or ask your lender to get it for you.

FAQ: How do I request a COE?

You can request a COE online through the VA's website. Go to the VA home loan COE page and click on "Request a COE" to start the process. You'll need to provide information about your military service.

Detailed COE Application Process

Obtaining your COE is a crucial step in the VA loan process. Here are the different methods you can use:

3 steps to obtaining VA COE Online through the eBenefits portal

- Create an account or log in to eBenefits

- Navigate to the "Apply for Home Loan Certificate of Eligibility" section

- Fill out the online form and submit

COE Application Through a VA-approved lender

Many lenders have access to the Web LGY system. They can often obtain your COE instantly.

COE Application By mail

Download and complete VA Form 26-1880. Mail it to your nearest VA regional loan center.

Required COE Application documents vary based on your service

Veterans: DD Form 214 (Certificate of Release or Discharge from Active Duty)

Active duty service members: Statement of Service signed by your commander, adjutant, or personnel officer

Current or former National Guard or Reserve members: Statement of Service and evidence of honorable service

COE Application Processing time:

- Online or through a lender: Often instant

- By mail: Usually within 10-15 business days

3. Find a VA-Approved Lender

Look for a lender experienced with VA loans. They'll understand the process and can guide you through it more effectively.

FAQ: How do I find a VA-approved lender?

You can use the VA's lender search tool on their website to find approved lenders in your area. You can also ask for recommendations from other veterans or your real estate agent.

Choosing the Right VA Lender

While the VA approves lenders, it doesn't recommend specific ones. Here's what to consider when choosing a VA lender:

Experience with VA loans

Look for lenders who specialize in VA loans and understand the unique requirements.

Competitive rates and fees

VA loans typically offer lower interest rates, but rates can vary between lenders.

Customer service

Read reviews and ask fellow veterans for recommendations.

Additional services

Some lenders offer additional support for veterans, such as dedicated customer service lines or special programs.

Lender's stability

Choose established lenders with a strong track record.

Remember to compare offers from at least three different lenders to ensure you're getting the best deal.

4. Get Pre-Approved

Pre-approval gives you a clear idea of how much you can borrow. Provide your lender with information about your income, assets, and debts. They'll review your credit and financial history to determine how much you qualify for.

FAQ: What's the minimum credit score for a VA loan?

The VA doesn't set a minimum credit score, but most lenders look for a score of at least 620. Some lenders may work with lower scores, so it's worth shopping around if your credit isn't perfect.

FAQ: What if I have used my VA loan benefit before?

You may be able to restore your entitlement to use a VA loan again. This is possible if you've sold the home and paid off the previous VA loan in full, or if you've paid off the loan but still own the home (this option is available one time only).

Understanding VA Loan Pre-Approval

Pre-approval is a more in-depth process than pre-qualification and gives you a clearer picture of your home buying power.

Documents typically required for VA Loan pre-approval:

- Proof of income (pay stubs, W-2 forms, tax returns)

- Bank statements

- Employment verification

- Rent payment history

- List of assets

- Certificate of Eligibility (COE)

Debt-to-Income (DTI) Ratio: The VA doesn't set a maximum DTI ratio, but most lenders prefer a DTI of 41% or less. However, you may still qualify with a higher DTI if you meet residual income requirements.

Residual Income: The VA requires that you have a minimum amount of income left over after paying major expenses. This amount varies based on your family size and location.

Credit Score: While the VA doesn't set a minimum credit score, most lenders look for a score of at least 620. Some lenders may work with lower scores, especially if you have a low DTI and meet residual income requirements.

5. Find a Home and Make an Offer

With your pre-approval in hand, start house hunting. When you find a home you like, make an offer. Your real estate agent can help with this process.

FAQ: Can I use a VA loan to buy any type of property?

VA loans are generally for primary residences only. You can buy a single-family home, a condo in a VA-approved project, a manufactured home, or a multi-unit property (up to four units) as long as you plan to live in one of the units.

5 Factors in a VA Property Appraisal Process

The VA appraisal is a crucial step in the loan process. Here are 5 things you need to know:

- Purpose: The appraisal ensures the home meets the VA's Minimum Property Requirements (MPRs) and assesses its value.

- MPRs include:

- Safe living conditions

- Sound structure

- Free from hazards and defects

- Adequate heating, water, and electricity systems

- Timeline: VA appraisals typically take 7-10 business days.

- Cost: The buyer usually pays for the appraisal, which can range from $300-$500 or more, depending on the location and property type.

- Possible outcomes:

- Appraisal matches or exceeds purchase price: The loan process continues.

- Appraisal comes in low: You may need to renegotiate the price, pay the difference out of pocket, or walk away from the deal.

- Property doesn't meet MPRs: Repairs may be required before the loan can be approved.

Remember, the VA appraisal is not a home inspection. It's still recommended to get a separate, comprehensive home inspection to identify any potential issues with the property.

6. Go Through the VA Appraisal Process

Once your offer is accepted, the VA will conduct an appraisal. This ensures the home meets VA standards and is worth the purchase price.

FAQ: What happens if the appraisal comes in low?

If the appraisal is lower than the purchase price, you have a few options. You can negotiate with the seller to lower the price, pay the difference out of pocket, or walk away from the deal. Your real estate agent can help you navigate this situation.

7. Close on Your Loan

If the appraisal goes well and you meet all lending requirements, you'll be ready to close on your loan. Review all documents carefully before signing.

FAQ: Do I have to pay closing costs with a VA loan?

While VA loans limit certain closing costs, you'll still have some expenses. You may be able to negotiate for the seller to pay some of these costs. The VA also allows you to roll the VA funding fee into your loan if you choose not to pay it upfront.

If you have questions about your eligibility or the VA loan process, contact Michael Tennant for more information. Michael Tennant, a licensed mortgage professional (NMLS #1404861).