Home Equity Line of Credit

A home equity line of credit (HELOC) is a revolving loan. The lender agrees to lend up to a maximum amount within a set period, called the term or draw period. The borrower’s property is used as collateral to secure the loan.

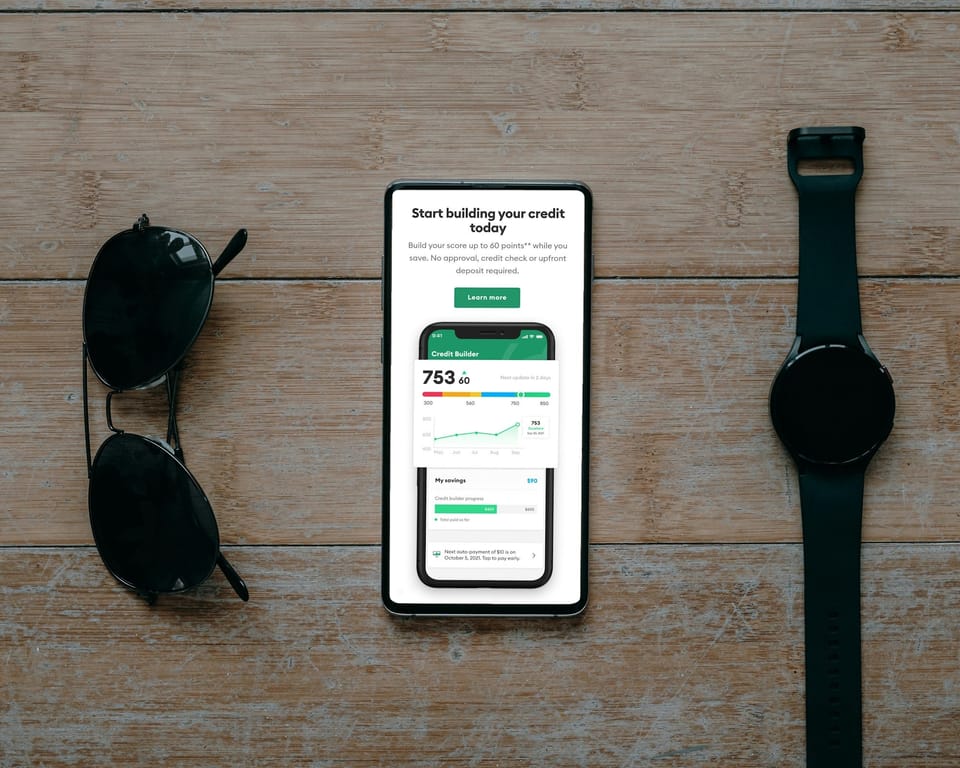

The short answer is yes, a HELOC can affect your credit score. However, the long term impact can be positive, depending on how you manage the account.

The interest you pay on a home equity line of credit may be tax-deductible, but there are specific conditions that must be met.

Refinancing your HELOC can be a strategic financial decision, especially in a favorable interest rate environment. By understanding your options and working with a trusted lender like Tennant Lending, you can make informed choices that align with your financial goals and needs.

A HELOC offers a flexible and convenient way to access the equity in your home, but it's essential to understand the terms, especially the draw period and how often you can borrow.

Navigating the process of applying for a HELOC can seem daunting, but with the right preparation and guidance, it can be a smooth and beneficial experience.

A HELOC offers a versatile and flexible financing option for homeowners, with the draw period serving as a critical component of its structure. Understanding how this period works, its typical timeline, and how it affects your financial obligations is essential.

This article will discuss the intricacies of paying off a Home Equity Line of Credit (HELOC) early and the potential penalties involved.

This article will explore how a Home Equity Line of Credit (HELOC) can affect your credit score, with insights from Tennant Lending, a licensed, premier mortgage lender based in Northern California.