Refinancing

Refinancing is the replacement of an existing debt obligation with another debt obligation under a different term and interest rate.

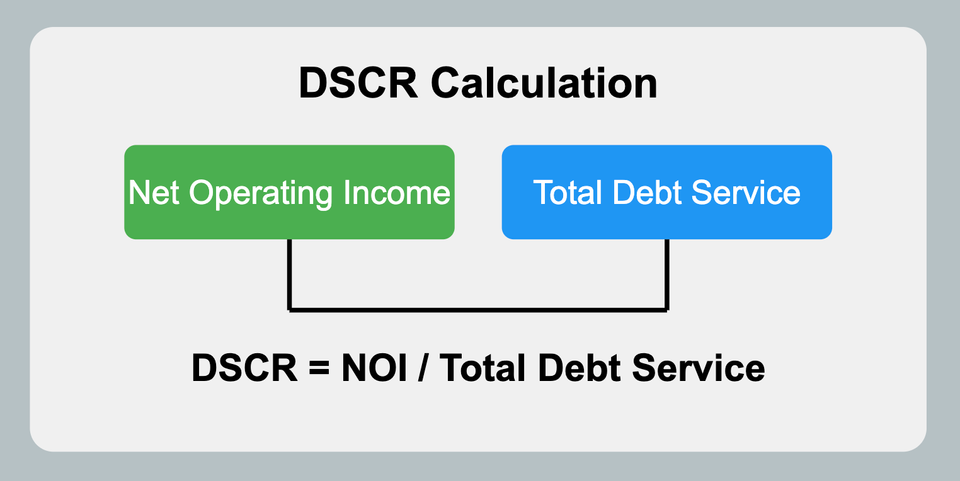

By mastering the intricacies of DSCR loans, savvy investors can leverage this tool to build robust, scalable real estate portfolios that generate steady cash flow and long-term wealth.

Discover the ins and outs of cash out refinancing, a strategy that lets homeowners tap into their home equity for cash, covering its definition, benefits, drawbacks, eligibility, application process, tax implications, and comparisons with other financial options.

Explore the pros and cons of cash-out refinancing, a strategy that allows homeowners to leverage their home equity for cash, through this comprehensive guide that provides detailed insights to help you make an informed financial decision.

Learn how to effectively leverage cash-out refinancing to access home equity for long-term financial goals, including home improvements, debt consolidation, education funding, emergency funds, real estate investments, and business growth.

Discover strategic mortgage refinancing options in California's 2024 real estate market, including rate-and-term, cash-out, and cash-in refinances, while navigating fluctuating interest rates, market trends, and legal considerations to optimize your financial benefits.

In this comprehensive guide, we'll explore the ins and outs of mortgage refinancing, including the types of refinancing available, the process involved, and how to decide if it's the right choice for you.

A cash-out refinance can be a valuable financial tool for homeowners looking to leverage their home equity. By understanding the preparation steps, qualifications, and the underwriting process, you can navigate the journey more confidently.

This article aims to explore the concept of debt consolidation loans, how they work, their pros and cons, and whether they are a good strategy for getting out of debt.

This comprehensive guide explores the intricacies of cash-out refinancing, exploring its workings, benefits, potential downsides, and how it compares to other equity-tapping methods like home equity loans.