Personal Finance

Tennant Lending's Personal Finance articles discuss basic topics in personal finance--including mortgages, consumer debt, investing basics, saving, and more. These articles are educational in nature and should not be read as investment advice.

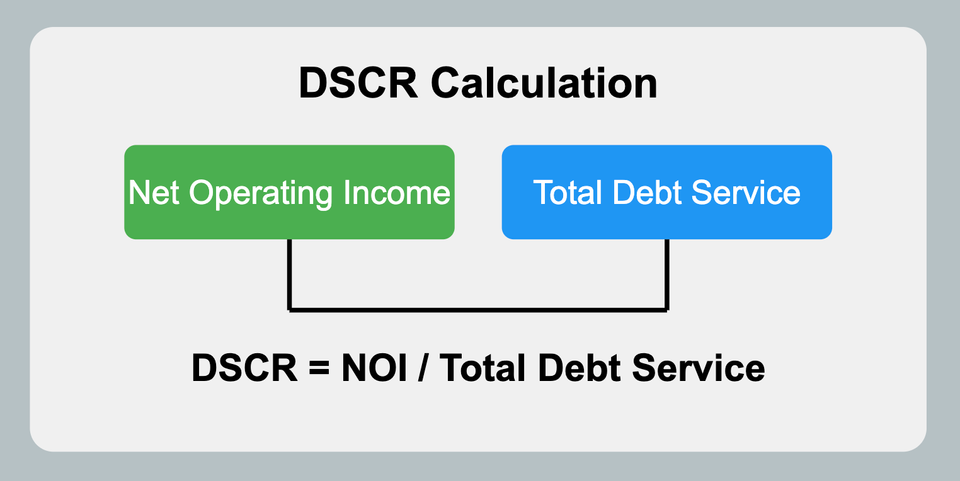

By mastering the intricacies of DSCR loans, savvy investors can leverage this tool to build robust, scalable real estate portfolios that generate steady cash flow and long-term wealth.

This article delves into the various assistance programs available, answering common questions and providing valuable insights to help you navigate the home buying process.

This comprehensive guide will help you understand what an underwater mortgage is, the various refinancing options available, and other critical considerations to manage your financial situation effectively.

One of the primary factors in qualifying for a HELOC is having sufficient equity in your home. Let's explore what qualifies or disqualifies you from obtaining a home equity line of credit.

This comprehensive guide dives into what HELOCs are, how they work, their advantages, and potential disadvantages. Whether you're considering renovations, consolidating debt, or funding major life events, a HELOC could be a valuable tool in your financial arsenal.

In this article, we'll explore the factors that influence your borrowing capacity, how to calculate potential loan amounts, and the differences between a HELOC and a home equity loan.

This article explores the nuances of using a HELOC for debt consolidation, drawing insights from various financial experts and institutions.

In this article, we will explore the current landscape of HELOC rates, how to calculate your potential payments, and where to find the best rates. Whether you're considering a HELOC or just shopping around, this guide will provide valuable insights.