Personal Finance

Tennant Lending's Personal Finance articles discuss basic topics in personal finance--including mortgages, consumer debt, investing basics, saving, and more. These articles are educational in nature and should not be read as investment advice.

In this comprehensive guide, we'll walk you through the documents you'll need to gather for your HELOC application, what to bring to your appointment, and other essential information to help you navigate the process smoothly.

Understanding the closing costs associated with a Home Equity Line of Credit is vital before proceeding with this type of loan. These costs can add up, impacting the overall affordability of the loan.

Home Equity Lines of Credit (HELOCs) have become a popular way for homeowners to leverage the equity in their homes for cash. While they offer flexibility and access to funds when needed, there are inherent risks involved in tapping into your home's equity.

This article explores how you can use a HELOC for leveraging your home equity, the advantages and considerations involved, and addresses some common questions related to buying additional properties.

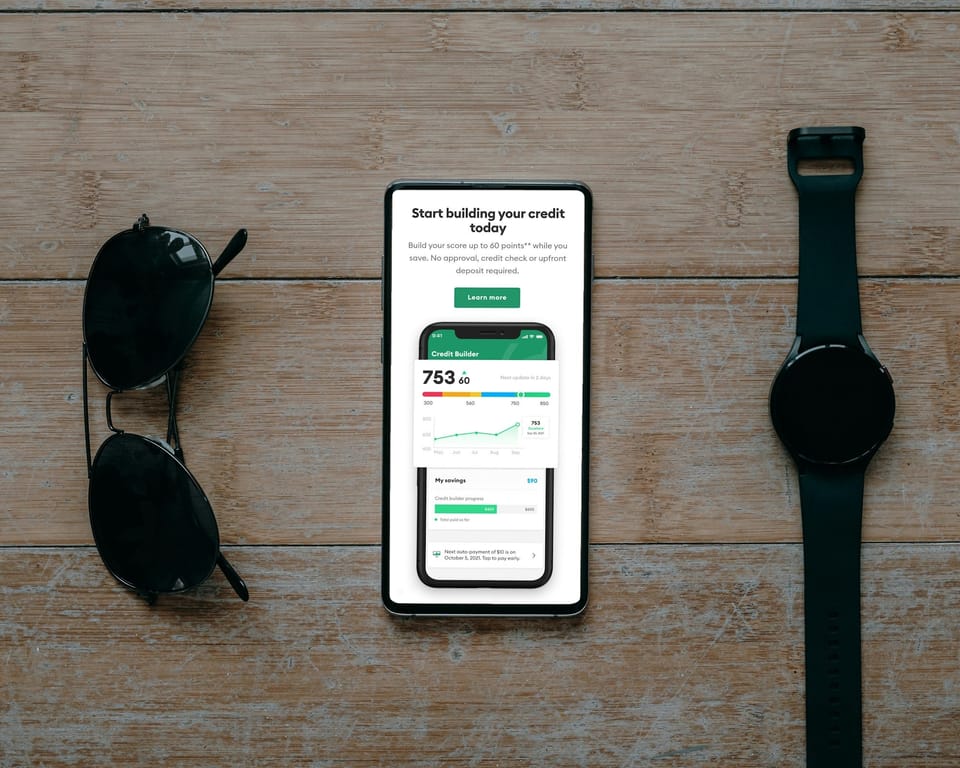

The short answer is yes, a HELOC can affect your credit score. However, the long term impact can be positive, depending on how you manage the account.

The interest you pay on a home equity line of credit may be tax-deductible, but there are specific conditions that must be met.

One of the final steps in securing your dream home is the mortgage closing, which involves a critical document known as the mortgage closing statement.

Purchasing your first home is a significant milestone that requires careful planning and consideration. By focusing on the essential aspects such as your budget, location, and a thorough inspection, and by preparing your finances, you can make informed decisions throughout the process.

Understanding the importance and benefits of soft pull pre approvals can significantly enhance the loan application experience.