VA Mortgage Loans

A VA loan is a mortgage loan in the United States guaranteed by the United States Department of Veterans Affairs (VA). The program is for American veterans, military members currently serving in the U.S. military, reservists and select surviving spouses (provided they do not remarry) and can be used to purchase single-family homes, condominiums, multi-unit properties, manufactured homes and new construction.

Recent changes in eligibility and loan limits are particularly relevant for veterans in California, given the state's high real estate prices. This article will explore these changes and their impact on California veterans.

Yes, you can use a VA backed loan to purchase a multli-family property, with a few conditions. This guide will walk you through the process, benefits, and considerations of using a VA loan to purchase multi-family properties for investment or residence.

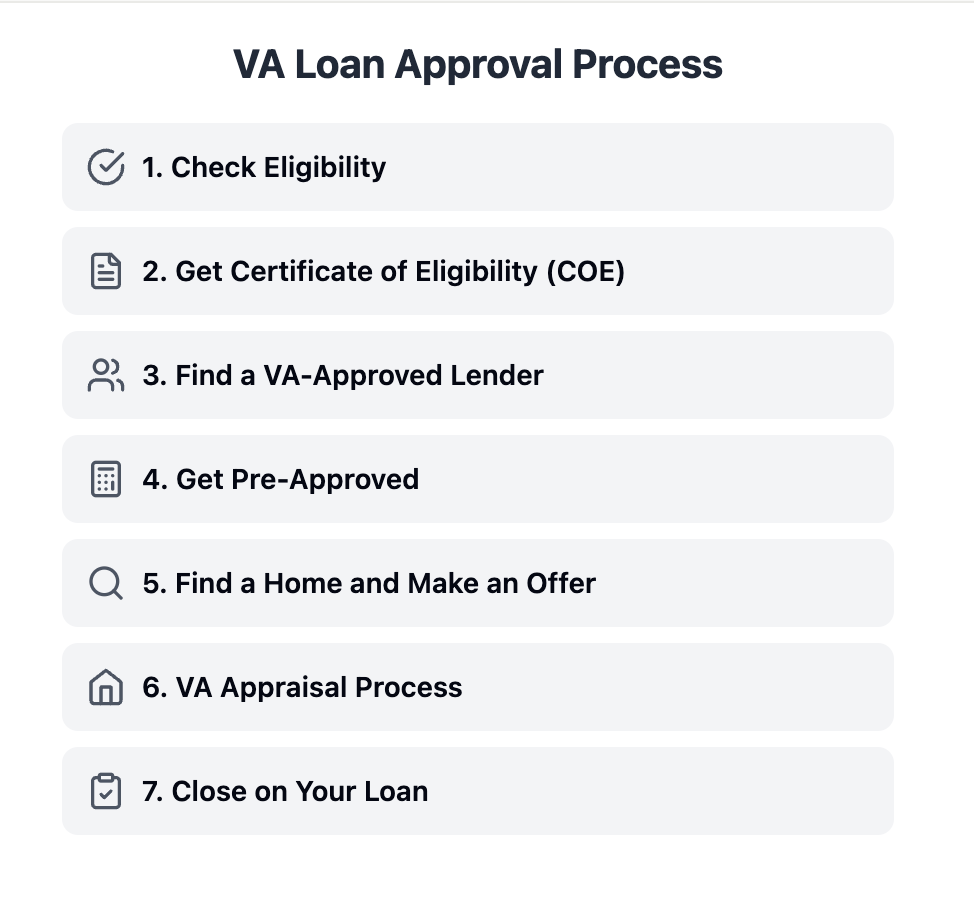

Getting approved for a VA home loan can be a straightforward process if you know what to expect. Here's a 7 step guide to help you navigate the VA loan approval process.

Choosing the right mortgage is a crucial step in the home buying process. By understanding the differences between VA and conventional loans, you can make an informed decision that best suits your financial needs and homeownership goals.

Improving your credit score, reducing your debt-to-income ratio, and ensuring a stable income can enhance your chances of getting approved for a VA loan. Additionally, working with a knowledgeable mortgage lender who understands the intricacies of VA loans is invaluable.

In this guide, we'll explore the essential details about VA home loan credit score requirements, leveraging insights from various authoritative sources and addressing common questions.

VA home equity loans offer a valuable financial tool for veterans, providing access to funds by leveraging home equity. Tennant Lending, with its expertise and dedication to serving those who have served, is an ideal partner for veterans seeking to navigate this option.

This article will explore the intricacies of VA home loan interest rates in 2023, highlighting how Tennant Lending stands out as a premier provider of these loans.

Created by the original G.I. Bill (Servicemen’s Readjustment Act of 1944), the VA-Guaranteed Home Loan program has helped generations of Veterans, Service members, and their families enjoy the dream of homeownership and the opportunity to retain their homes in times of temporary financial hardship.