Homeowners often seek ways to leverage the equity in their homes for various financial needs, such as home improvements, debt consolidation, or other major expenses. Two popular options for tapping into home equity are Home Equity Lines of Credit (HELOCs) and Home Equity Loans. While both allow homeowners to borrow against the value of their homes, they operate differently and serve different purposes. This comprehensive guide will explore the differences between HELOCs and Home Equity Loans, their respective advantages and disadvantages, and how to determine which option might be best for you.

Understanding Home Equity

What is Home Equity?

Home equity is the portion of your home that you truly own. It is calculated by subtracting the amount you owe on your mortgage from the current market value of your home. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, your home equity is $100,000.

How Home Equity Grows

Home equity can grow in two primary ways: 1. Paying Down Your Mortgage: Each mortgage payment reduces the principal balance, increasing your equity. 2. Appreciation: If the market value of your home increases, so does your equity.

What is a Home Equity Loan?

Definition

A Home Equity Loan is a type of loan in which the borrower uses the equity of their home as collateral. It is also known as a second mortgage.

How It Works

- Lump Sum Payment: Borrowers receive a lump sum of money upfront.

- Fixed Interest Rate: The interest rate is usually fixed, meaning it does not change over the life of the loan.

- Repayment Terms: Repayment terms are typically fixed, with monthly payments over a set period, often ranging from 5 to 30 years.

Advantages of Home Equity Loans

- Predictability: Fixed interest rates and fixed monthly payments provide predictability and stability.

- Large Sum Access: Ideal for large, one-time expenses such as home renovations or debt consolidation.

Disadvantages of Home Equity Loans

- Risk of Foreclosure: Using your home as collateral means you risk losing it if you default on the loan.

- Upfront Costs: May include closing costs, appraisal fees, and other charges.

What is a HELOC?

Definition

A Home Equity Line of Credit (HELOC) is a revolving line of credit secured by the equity in your home. It functions similarly to a credit card.

How It Works

- Credit Limit: Borrowers are approved for a maximum credit limit based on their home equity.

- Draw Period: During the draw period (usually 5-10 years), borrowers can withdraw funds as needed.

- Repayment Period: After the draw period, borrowers enter the repayment period (usually 10-20 years), during which they must repay the borrowed amount.

- Variable Interest Rate: Interest rates are typically variable, meaning they can fluctuate over time.

Advantages of HELOCs

- Flexibility: Borrowers can withdraw funds as needed, making it ideal for ongoing expenses.

- Interest-Only Payments: During the draw period, borrowers may have the option to make interest-only payments.

Disadvantages of HELOCs

- Variable Rates: Interest rates can increase, leading to higher monthly payments.

- Risk of Foreclosure: As with Home Equity Loans, defaulting on a HELOC can result in foreclosure.

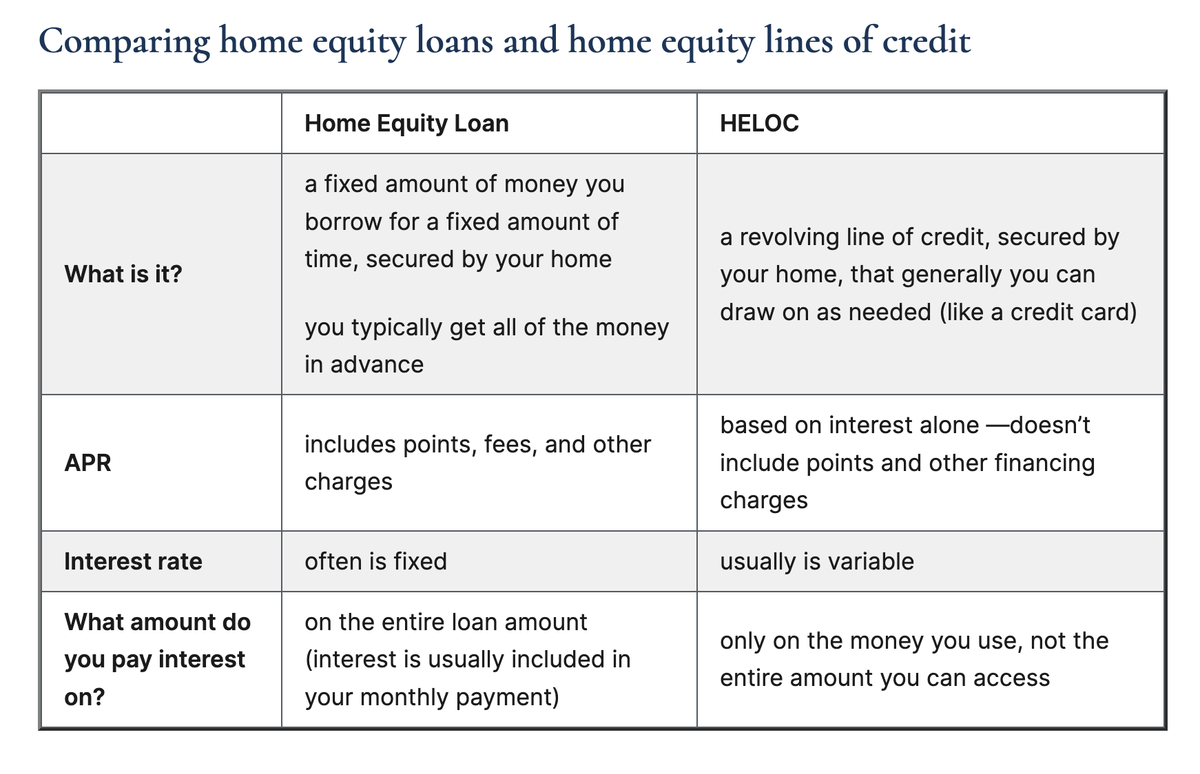

Key Differences Between HELOCs and Home Equity Loans

Structure

- Home Equity Loan: Lump sum payment with fixed interest rates and fixed repayment terms.

- HELOC: Revolving line of credit with variable interest rates and flexible withdrawal options.

Interest Rates

- Home Equity Loan: Fixed interest rates.

- HELOC: Variable interest rates.

Repayment

- Home Equity Loan: Fixed monthly payments over a set period.

- HELOC: Interest-only payments during the draw period, followed by principal and interest payments during the repayment period.

Use Cases

- Home Equity Loan: Best for large, one-time expenses.

- HELOC: Best for ongoing or unpredictable expenses.

How to Qualify for a HELOC or Home Equity Loan

Eligibility Requirements

- Credit Score: Lenders typically require a good credit score (usually 620 or higher).

- Home Equity: Sufficient home equity, often at least 15-20% of the home's value.

- Debt-to-Income Ratio: A manageable debt-to-income ratio, usually below 43%.

Application Process

- Assess Your Equity: Determine your home equity by getting a current appraisal and subtracting your mortgage balance.

- Check Your Credit: Review your credit report and score.

- Compare Lenders: Shop around for the best rates and terms.

- Submit Application: Provide necessary documentation, such as proof of income, tax returns, and property information.

- Underwriting and Approval: The lender will review your application, conduct an appraisal, and decide whether to approve your loan or line of credit.

Pros and Cons of HELOCs and Home Equity Loans

Pros of Home Equity Loans

- Predictable Payments: Fixed interest rates and fixed monthly payments.

- Large Lump Sum: Access to a significant amount of money upfront.

Cons of Home Equity Loans

- Upfront Costs: May include closing costs and fees.

- Risk of Foreclosure: Defaulting can lead to losing your home.

Pros of HELOCs

- Flexibility: Withdraw funds as needed.

- Interest-Only Payments: Option to make interest-only payments during the draw period.

Cons of HELOCs

- Variable Rates: Interest rates can increase.

- Risk of Foreclosure: Defaulting can lead to losing your home.

When to Choose a Home Equity Loan

Ideal Scenarios

- Large, One-Time Expenses: Such as home renovations, medical bills, or debt consolidation.

- Fixed Budget: When you prefer predictable monthly payments and a fixed interest rate.

Considerations

- Upfront Costs: Be prepared for closing costs and fees.

- Long-Term Commitment: Understand the long-term repayment commitment.

When to Choose a HELOC

Ideal Scenarios

- Ongoing or Unpredictable Expenses: Such as home improvements over time or educational expenses.

- Flexibility: When you need the flexibility to borrow as needed.

Considerations

- Variable Rates: Be aware of the potential for rising interest rates.

- Draw and Repayment Periods: Understand the terms of the draw and repayment periods.

Official Resources and Further Reading

For more detailed information and official guidelines, you can refer to the following resources:

- Consumer Financial Protection Bureau (CFPB) - Home Equity Loans and HELOCs

- Federal Trade Commission (FTC) - Home Equity Loans and Credit Lines

- U.S. Department of Housing and Urban Development (HUD) - Home Equity Conversion Mortgages

Conclusion

Understanding the differences between a HELOC and a Home Equity Loan is crucial for homeowners looking to leverage their home equity. Each option has its own set of advantages and disadvantages, and the best choice depends on your specific financial needs and circumstances. By carefully considering the structure, interest rates, repayment terms, and use cases of each option, you can make an informed decision that aligns with your financial goals.

Always consult with a financial advisor or mortgage professional to explore your options and ensure you choose the best solution for your situation.

Sign up for Tennant Lending

Tennant lending is a real estate education center. Our mission is helping families grow wealth by facilitating real estate ownership throughout the country.

No spam. Unsubscribe anytime.